Justin Sullivan

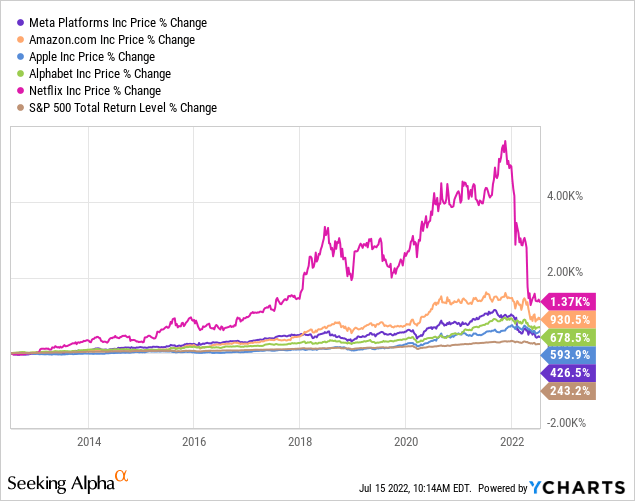

I feel absolutely everyone listed here has heard about the FAANG stocks, as these big tech names have delivered amazing returns over the previous decade. While some of the companies have modified their name more than that time, the letters represent Facebook/Meta Platforms (META), Apple (AAPL), Amazon (AMZN), Netflix (NFLX), and Google – or as it is really now known, Alphabet (GOOG, NASDAQ:GOOGL).

Any investors in these organizations considering that 2012 have been extremely effectively rewarded, with each individual organization easily outperforming the benchmark S&P 500.

But investing is a forward-wanting recreation, so which of these firms must see the greatest sum of good results in the decade to appear? While you could make a persuasive case for any, my decide on is Alphabet, and I’ll explain to you why.

Small business Overview

Alphabet divides itself up into two core Google-relevant segments: Google Solutions and Google Cloud, with a more phase for Other Bets.

The items and platforms at the heart of Google Companies consist of advertisements, Android, Chrome, hardware, Gmail, Google Drive, Google Maps, Google Shots, Google Engage in, Look for, and YouTube. These are all companies that we arrive into get hold of with each and every day I’m at the moment making use of Google Chrome and Google Look for to do a large amount of the investigation for this posting. The hardware goods also available by Google incorporate the Pixel smartphones, Fitbit, Chromecast, and the Google Nest Cams and Doorbell.

Google Cloud is the company’s cloud platform & a challenger to the likes of Amazon’s AWS and Microsoft’s Azure. It also features Google Workspace, which generates revenues from cloud-based mostly collaboration instruments for enterprises such as Gmail, Docs, Travel, Calendar, and Fulfill.

A snapshot of just some of Alphabet’s offerings (Google)

The closing offering from Alphabet is the Other Bets segment, which is primarily enterprise funds. It invests in emerging corporations at a variety of levels of advancement with a goal for them to turning into flourishing, thriving companies in the medium to lengthy phrase. The most effectively-identified of these Other Bets is likely Waymo, an autonomous driving start-up.

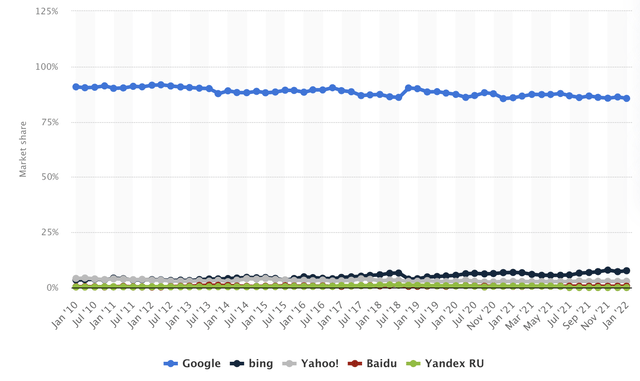

Alphabet has a robust business model throughout lots of of these unique regions. In the search engine current market, Google is the clear chief and has been for some time, with a world-wide sector share higher than 85% as of January 2022 according to Statista. When it will come to Look for, Google has very clear competitive benefits from its brand name identify as nicely as a technological advantage its machine studying has outperformed all other “rivals” about the final decade.

World-wide Look for Motor Current market Share (Statista)

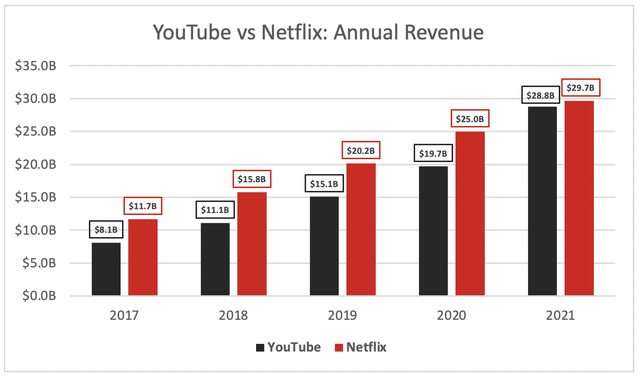

The enterprise also acquired YouTube back again in 2006 for a whopping $1.65 billion… which, provided YouTube’s current efficiency, seems to be like an absolute steal! In point, YouTube grew revenues to an spectacular ~$29 billion in 2021, pretty much overtaking the pure-engage in streaming chief & fellow FAANG member Netflix.

SEC Filings, Excel

Let’s not neglect about Google Cloud it may well however be powering leaders Amazon and Microsoft, but has the possible to be a considerable earnings driver for Google more than the impending several years, as we have previously witnessed with AWS and Amazon (& as I highlighted in a recent short article). Google is nonetheless pretty a lot in the expense stage of its cloud infrastructure, and I believe its future appears dazzling in this article much too.

It is plain that Alphabet has a bunch of brilliant corporations, with a lot of dominating their core industries… but who cares? Accurately the exact same could be mentioned for the rest of the FAANG shares. So likely on the assumption that all these providers have superb business enterprise types, what separates Google from the relaxation of the pack?

Economic Fortitude

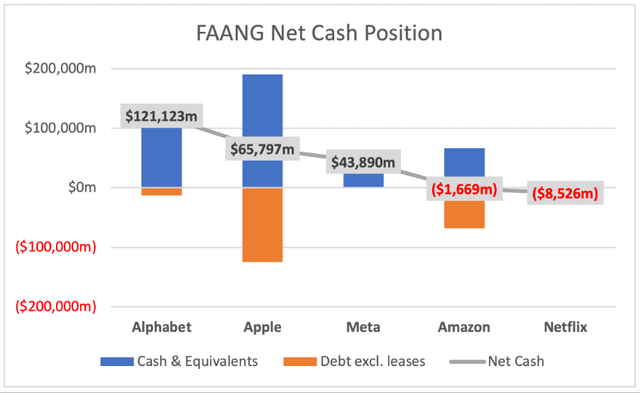

A single of the most significant drivers for potential advancement when it comes to these FAANG shares is their capacity to diversify, test out new issues, and check out fascinating, progressive, and likely lifestyle-shifting technologies to create new profits streams – but in purchase to do that, the businesses must be both economically secure & also have a war chest of dollars to shell out. So, how do they stack up? Alphabet is in a league of its possess, with pretty much double the net money posture of its closest FAANG competitor Apple.

SEC Filings / Excel

This, merged with Alphabet’s frequent attempts to find and acquire the up coming ‘big thing’ to travel their company ahead really should be a successful mix for shareholders. The corporation even phone calls out its tactic to “Moonshots” in its annual report:

Several businesses get at ease doing what they have generally done, generating only incremental adjustments. This incrementalism qualified prospects to irrelevance over time, primarily in technological know-how, where improve tends to be innovative, not evolutionary. Individuals believed we were ridiculous when we obtained YouTube and Android and when we released Chrome, but those people efforts have matured into big platforms for digital movie and cellular equipment and a safer, preferred browser. We go on to glimpse toward the foreseeable future and to devote for the prolonged phrase inside of each and every of our segments. As we reported in the first founders’ letter, we will not shy away from substantial-possibility, large-reward assignments that we imagine in, as they are the key to our very long-phrase results.

So not only does Google have the lifestyle to pull off these Moonshot attempts, but it has the money on hand as well.

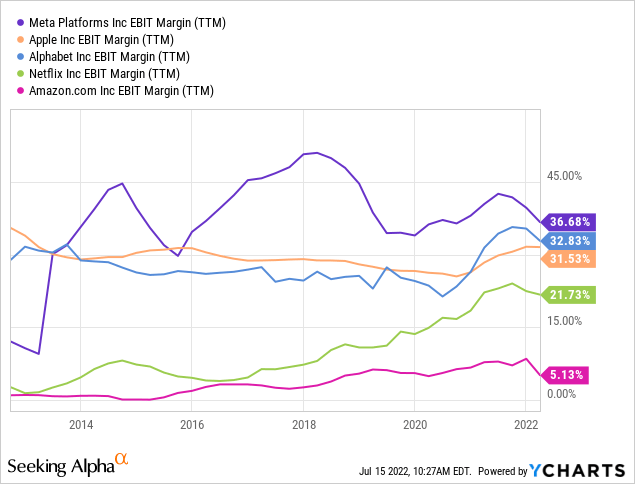

What about the small business model itself? Is it intended in a way these that it will carry on to produce worth for shareholders? I personally appear for potent margin profiles in any business that I spend in, and Google has continuously generated the second greatest EBIT margins among any FAANG stock – next only to Meta, who I am not the most significant admirer of for motives that I mention in this previous post.

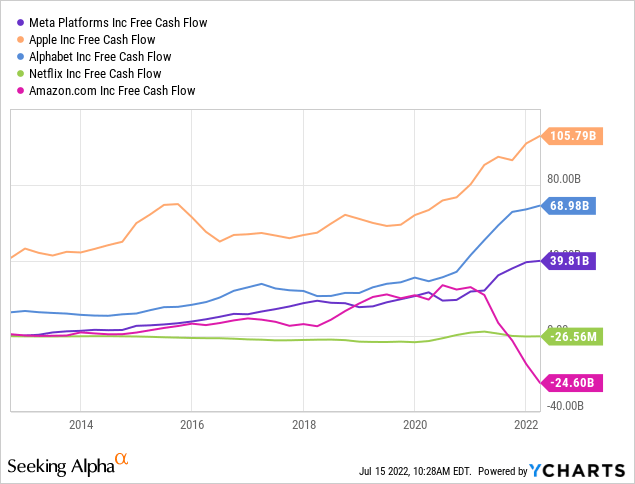

Blend these high margins with an already insane hard cash balance, and you get a enterprise that will not only continue on to print cash, but is also in a ridiculously potent situation to acquire risks and reinvest in any options for advancement – these kinds of as Google Cloud. If we also just take a glimpse at cost-free dollars flow in complete conditions, Google is also the 2nd most effective of the FAANGs – this time second to Apple.

It really is distinct that Google has 1 of the greatest fiscal profiles of any FAANG stocks, but what does the long term hold for this tech behemoth?

Expansion Prospects

Even though the earlier and current have designed Alphabet the organization it is nowadays, and served to establish out a reasonably impenetrable moat, the specific exact same can be explained for numerous other FAANG shares. The query now is no matter if or not any of these FAANG companies can go on their history of extraordinary growth, because this is what will be needed to maintain shareholders satisfied.

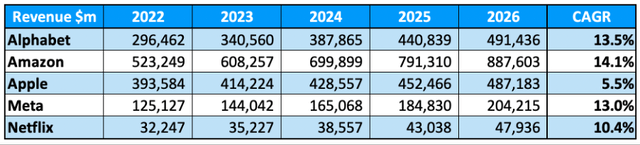

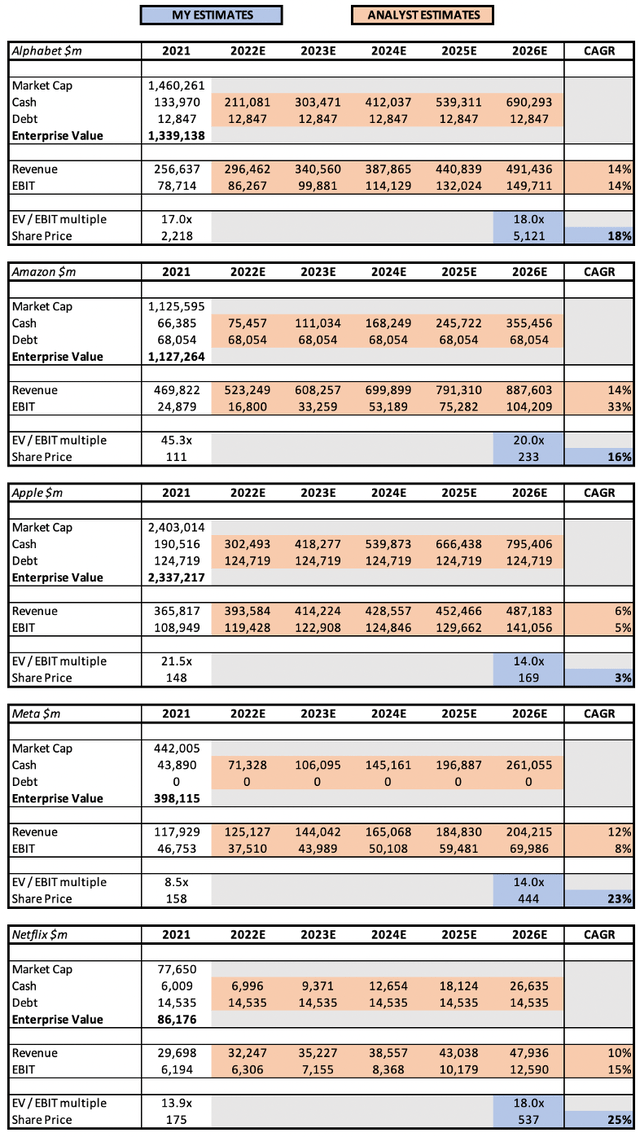

I think that Alphabet has a number of tailwinds in its again for the 10 years in advance secular advancement in electronic advertising (Google Research), secular growth in streaming (YouTube) secular development in cloud computing (Google Cloud), and quite a few extra development stories that Alphabet is involved in. However a selection of traders will make the incredibly exact situation for all the other FAANG stocks, so let’s acquire a seem at what the analysts consider will happen in excess of the upcoming 5 a long time, courtesy of TIKR.

TIKR.com / Excel

In phrases of profits development, Alphabet comes out in its clear beloved posture – second best, this time driving still another different FAANG competitor, Amazon. While the distinction among Alphabet, Amazon, and Meta is modest in phrases of the expected CAGR, I think this demonstrates that development is undoubtedly nonetheless there for these companies & they have an possibility forward. Apple, one of the stock market’s darlings, is definitely not envisioned to expand at a similar charge to these companies – so possibly we will begin seeing a adjust at the top rated of the FAANG?

Valuation

Let’s get down to valuation, since at the finish of the day these are all different providers with unique paths forward, and as a result they really should all have distinctive valuations. I’m heading to use a marginally simplified edition of my normal valuation product to get a tough plan of the individual valuations of these companies as opposed to their 2026 likely.

TIKR.com / Excel

In situation it’s difficult to see from the design, these are the effects for the share selling price CAGR by to 2026:

- Alphabet: 18%

- Amazon: 16%

- Apple: 3%

- Meta: 23%

- Netflix: 25%

In terms of EV / EBIT multiples, I imagine that 12x signifies an suitable various for a steady business enterprise, and a 16x many signifies an appropriate various for a stable-nevertheless-developing enterprise. Amazon receives a greater several because of to the probable for EBIT margin expansion, Apple receives a decrease various because of to its lower growth rates, and Meta receives a decreased many owing to the danger involved with both of those its image as a business & the tried metaverse shift.

In accordance to my model Meta and Netflix are giving the best return, but why is this? Since I experience like these companies are at this time most at chance of failing to attain their development amount. Meta is struggling with a true general public relations problem, and the shift into the metaverse feels like a lengthy shot that HAS to function for the company, in any other case it could face a tricky future. Netflix is in the same way risky correct now, as it has been hemorrhaging subscribers and traders are awaiting a turnaround. I never believe that pitfalls of these ranges exist for Alphabet, Amazon, or Apple. This points out why equally Netflix and Meta are at the moment investing at valuations that surface to be way underneath honest price – the market place is wise, and charges in this threat.

What is actually The Summary?

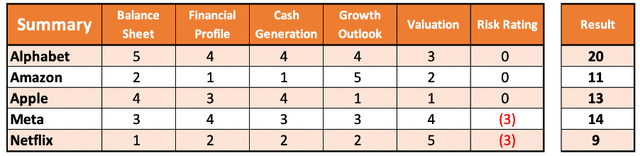

I’ve taken a glance at Alphabet with regard to the other FAANG stocks, but how do I conclude which is the best of the bunch? Very well, I’ll try and do it in a methodical method – by rating just about every firm in every class out of 5, and then seeing who gets the best rating.

Excel

Whilst all the FAANG shares excel in a person or two distinct areas, Alphabet is the only one particular that has strengths across the board. I never assert to condition that this simplistic rating process offers an exact forecast of the good results of these FAANG shares – I individually want Amazon as an expenditure over Apple or Meta. But what it does clearly show is that Alphabet appears to be a much far more properly rounded organization.

All of the providers above are wonderful in their individual appropriate. But I believe that Alphabet is certainly in a class of its own, and will show to be the very best FAANG stock above the approaching 10 years.

.png)

More Stories

The Impending Writers’ Strike and Its Potential Impact on the Advertising Industry

Selling to the World’s Largest Customer

They don’t measure up to AirPods Pro