Google Stock Q1 Earnings: Warren Buffett Should Take Another Look (NASDAQ:GOOG)

EnDyk/iStock Editorial by using Getty Pictures

Financial commitment Thesis

Following Google (NASDAQ:GOOG) noted its outcomes on April 26, its share rate fell by more than 10% for the duration of right after-industry trading. And as I wrote this (in advance of the industry opened on April 27), its share price tag is continue to down by a lot more than 4.5% ($2280). The prices could possibly have transformed a bit again when you read supplied the industry volatility. In my perspective, this kind of share value moves are irrational, and the current market has overacted (the marketplace has presently been on edge in new times to start with).

Warren Buffett regretted in 2019 for creating the completely wrong connect with in not shopping for GOOG. All these good reasons for his regret are nevertheless valid now, and likely even extra so just after the Q1 earnings release noted yesterday, for the following things to consider.

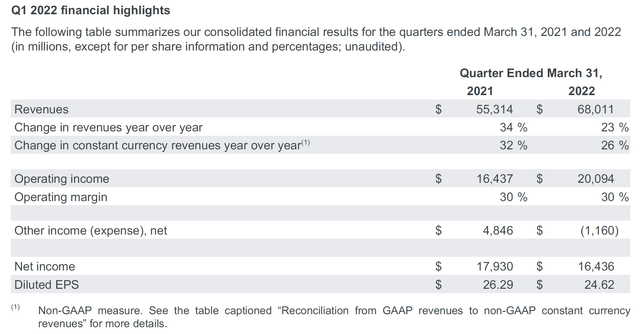

To start with, the business even now matches all the attributes that he seems for in a perpetual compounder – the large moat, the toll position in the economic ecosystem, and incredibly substantial return on capital used. GOOG not only documented a strong Q1, but its underlying enterprise is nevertheless robust as ever and is effectively-positioned for the long term at the exact time. Full revenues grew by much more than 20% YoY and the functioning margin is secure at a extremely competitive amount of 30%, as you can see from the chart down below.

2nd, the enterprise generates sturdy hard cash stream to assist each organic and natural progress, acquisitions, and reward shareholder generously by means of share repurchases. In individual, CEO Pichai stated that “Cybersecurity has been a distinct emphasis… we naturally are thrilled about our acquisition of Mandiant (MNDT).” Also, soon right before the earnings release, the Board of Directors licensed a new share repurchase strategy and upsized the old system up to an further $70. billion of its Class A and Class C shares

Ultimately, the the latest selloff has brought the valuation to a compressed degree. At present, the accounting PE is underneath 20x. And the PE based on accurate financial earnings is even reduced. These a valuation, blended with the sturdy small business fundamentals and advancement potential, can very easily help a double-digit full return in the extended time period.

Now, we dive into the details of the earnings and tackle some of the essential industry fears.

GOOG Q1 Earnings Report GOOG Q1 Earnings Report

Earnings Highlights And Sector Fears

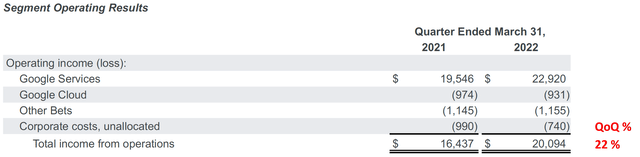

As you can see from the next chart, GOOG described fantastic growth in Q1 throughout the board. In particular:

- Its main bread-and-butter enterprise, Google Promoting, observed a 22% expansion in its full revenues. This main incorporates the common Google Look for, YouTube, and Google Community. And their revenues all grew in the double-digit range (Google Lookup & Other grew about 24%, YouTube Adverts grew about 14 %, and Google Network grew more than 20).

- Its Cloud segment grew extra than 45% in whole revenues. Admittedly, Google Cloud is however not rewarding nonetheless and its functioning loss was even a little bit bigger than the exact same quarter final yr (by about 4%). But the Google Cloud Platform is in a dominating place with each other with Microsoft Azure and Amazon AWS in this strategic new region. It offers a wide set of abilities, covering a entire selection of company IT requires from SaaS to PaaS and IaaS. I have no question that it will come to be successful quickly and take pleasure in large progress provided the secular assistance and the world’s tetanic shift in the direction of the pay out-as-you-go design.

GOOG Q1 Earnings Report

Now let’s analyze the not-so-fantastic aspects and handle the marketplace considerations. Initially, YouTube’s growth slowed down. YouTube Adverts grew “only” by ~14 %. In distinction, it grew far more than 25% in the preceding quarter. This deceleration arrived together with some industrywide advertising and marketing hiccups with the start off of the Russia-Ukraine war. And my check out is that A) 14% expansion is presently amazing, and B) the gradual down most likely will be non permanent. As Chief Money Officer Ruth Porat pointed out,

“The most direct impact (of the war) is the simple fact that we suspended the extensive the vast majority of our professional functions in Russia… About 1% of Google revenues had been from Russia in 2021, and that was principally from advertising”. She provides that from the outset of the war there was a pullback in advertiser expend, “specifically on YouTube in Europe.”

A further worry bordering YouTube is the level of competition with rival TikTok (BDNCE) in limited movies. All over again, my look at is that such problem is overblown. YouTube shorts are progress a rapid pace and catching up quickly. From CEO Pichai’s remarks, YouTube Shorts now averages in excess of 30 billion day by day sights, up more than 4 occasions from a 12 months ago. It will choose some time for YouTube to monetize but the effects are promising so considerably, as commented by CFO Ruth Porat,

“We are screening monetization on Shorts, and early advertiser feedback and results are encouraging,” she says. “And the crew is concentrated on closing the hole with standard YouTube advertisements above time. So we are fired up about the new prospects with Shorts, but a slight headwind.”

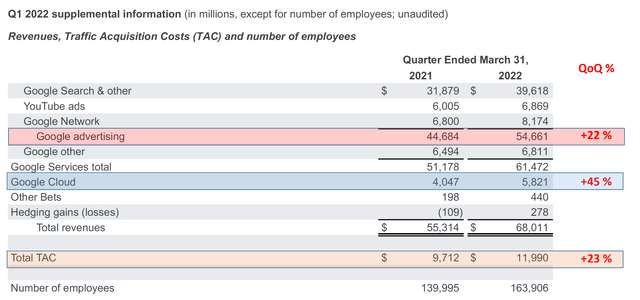

Finally, the actual worry to me is the growing cost of TAC (Visitors Acquisition Fees). The TAC is just one of the company’s most sizeable, however hard to design, costs (and as a result the minimum reviewed). A complete discussion of the TAC likely merits more than one short article. And in this article I will briefly summarize my sights. First of all, TAC is the price that Google has to spend to acquire targeted traffic. It involves the fees that GOOG pays to its community customers and also its distribution companions. 2nd, regrettably, the TAC has been increasing at a swift speed as well as levels of competition in the electronic advert planet intensifies. As viewed, TAC rose by 23% QoQ, slightly outpacing the earnings advancement in its core segments (22%).

I would not be alarmed by this modest change nonetheless, it is a fundamental metric that requires to be intently monitored. As aforementioned, it is a important value for GOOG and the competition in the digital ad house could more push up this charge. At the same time, GOOG’s efforts to diversify its ecosystem could assistance stabilize it (these types of as the distribute of its Chrome browser and Android OS).

Valuation And Buffett’s Price Line

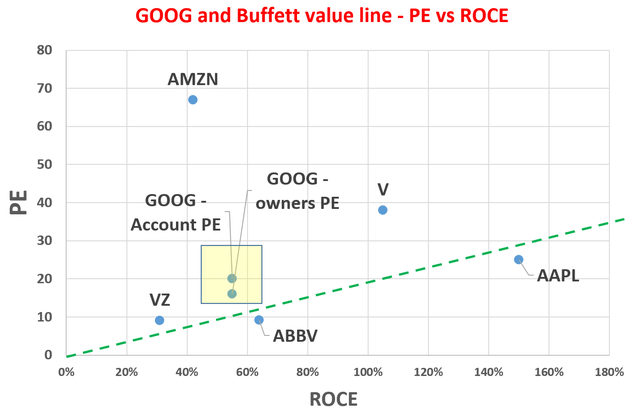

Going on to valuation. The market place overreaction has brought the valuation to a compressed stage (the accounting PE is down below 20x as of this composing). And as specific in my earlier posting, its true financial or owners’ earnings have been persistently far better than its accounting earnings due to the fact the growth CAPEX demands to be additional back to the owners’ earnings. After adjusting for the advancement CAPEX, its PE is about 16x primarily based on its owners’ earnings according to my assessment.

A further a single of my preferred valuation metrics is the subsequent chart, comparing the PE vs return on cash employed (“ROCE”) for several Buffett-style enterprises. Rather of seeking at PE on your own, it can make a lot more feeling to search at PE in the context of high-quality. And the chart demonstrates far more insights by just accomplishing this – it displays valuation adjusted for profitability. The eco-friendly line is what I get in touch with the Buffett price line. It is a line linking A) the origin (a business that has ROCE must be truly worth zero PE), and B) Buffett’s most significant keeping AAPL (which comes about to have the greatest ROCE among this team of stocks). As you can see, GOOG’s valuations are getting truly close to this line now, particularly if you take into account its PE based on the owners’ earnings.

Writer

Searching forward,

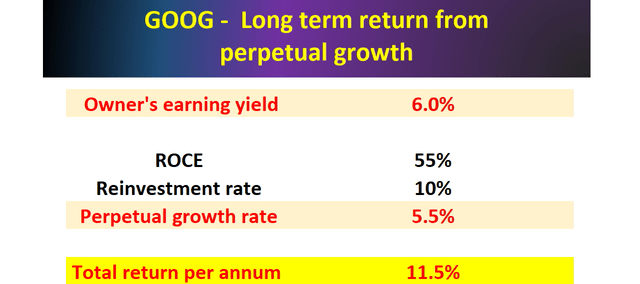

- As demonstrated in the upcoming chart, at its current price tag ranges, a double-digit total return can be easily supported in the lengthier conditions. The long-phrase return is projected to consist of about 6% of owners’ earnings yield (all over again about 16x PE based mostly on owners’ earnings as aforementioned) and about 5.5% natural progress.

- These types of projection is on the conservative facet due to the fact it excluded other essential and perhaps sizable return drivers. 1st, it excluded growth by way of acquisitions. For case in point, the following massive GOOG catalysts will be the Google I/O developer conference due in two months, and CEO Pichai observed attendees would get some depth on the new acquisition of MNDT in Cybersecurity. Second, it excluded the role of share repurchases. The Board of Administrators just upsized the aged share repurchase prepare up to an additional $70B. These a sizable repurchase, mixed with its presently compressed valuation, will be really powerful to enhance shareholder returns. And last but not least, it excluded the nonlinear development potential from its Other Bets group.

Writer

Summary And Threats

The industry overaction to the Q1 earnings launch has introduced the valuation to a extremely desirable level. And the small business however fits all the attributes of a perpetual compounder basically. In certain,

- Current market fears about its YouTube “slowdown” are overblown, although its soaring TAC is of extra fundamental worry.

- Its valuation is even further distorted by its major expense in progress CAPEX, about 24% of its whole CAPEX on typical in modern yrs. As a outcome, its valuation is even lower than what is on the surface. The PE primarily based on GAAP is under 20x now as of this producing, and the PE centered on its real financial earning is only about 16x.

- Recent cost ranges can assist a double-digit total return conservatively. It is conservative due to the fact it excluded progress by acquisitions, the job of share repurchases, and the nonlinear advancement potential from its Other Bets classification.

Although there are a couple of pitfalls to bear in mind (aside from individuals described presently in the article these as the increasing TAC prices):

1st, the greatest a single as I can see is the Russian/Ukraine war. GOOG has now suspended its industrial activities in Russia and this sort of suspension has now harm its gains. The length and final final result of the war are entirely unpredictable (as with any war). And it could negatively impact the total fiscal marketplace and also Google. Even although GOOG’s possess PE is in a really sensible array as argued previously mentioned. But the all round industry alone is nevertheless in close proximity to a historic file valuation and the war can produce substantial industry volatility. These types of a mixture of volatility and higher marketplace valuation certainly could lead to some limited-expression risks for GOOG stock value.

Then there is also a remote probability of an anti-have confidence in regulatory possibility. The US Justice Department has been investigating how Google maintains its electric power in the digital advertisement market place. These investigations could possibly lead to a second antitrust lawsuit from Google in the in the vicinity of long term.