The crypto carnage has a single silver lining: the broader economical technique has been spared.

From Brussels to Washington, finance watchdogs downplay the threat of turmoil spilling into other markets and argue that their own actions have guarded financial institutions from the crypto tailspin.

“This contagion did not lengthen into the classic banking and finance sector,” the performing US comptroller of the forex Michael Hsu instructed the Fiscal Situations.

“This is due, at least in section, to federal bank regulators’ ongoing and intentional emphasis on safety, soundness and customer security,” he mentioned.

On Thursday, world wide regulators in Basel went further — proposing tougher regulations to cap crypto publicity at 1 for every cent of a bank’s property.

The Federal Reserve, which recently launched the final results of its annual pressure tests exhibiting the most significant US financial institutions could put up with additional than $600bn in losses and nonetheless exceed authorities-mandated capital stages, sees confined financial institution publicity to crypto marketplaces, in accordance to Fed officials.

Outside the banking sector, firewalls incorporate expenditure pointers for institutional traders that restrict their exposure to electronic assets, mentioned an official at the Securities and Exchange Commission.

The formal additional there had been no signals the crypto offer-off experienced induced a dash for hard cash from investors looking for redemptions of common securities to go over losses in crypto, while the SEC was however checking this exercise.

“For mainstream asset professionals, the direct impression of the crypto promote-off is rather negligible,” stated Anne Richards, chief government of Fidelity Worldwide. “Bitcoin created its way into a small variety of institutional portfolios but for most teams it’s nonetheless incredibly considerably on the fringes.”

Andrea Enria, the European Central Bank’s top rated banking supervisor, instructed a European Parliament committee on Thursday there have been “still quite limited” connections concerning crypto and financial institutions.

“But I recognize improved desire by the banking institutions to perhaps enter these markets as they see youthful populations probably extremely interested . . . I also see, in standard, higher instability in the sector so the sooner we can control and give crystal clear advice, the better.”

Paschal Donohoe, Irish finance minister and president of the eurogroup of finance ministers, stated officials had been not involved at the moment, but additional: “I can picture that in a year’s time we will be as focused on cryptocurrencies as we are on weather risk, which is amid our prime concerns.”

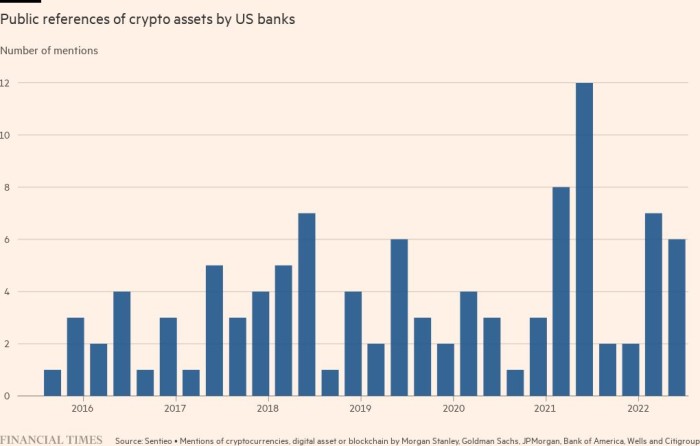

Big controlled banks have found techniques to present crypto goods to clientele. Jamie Dimon’s JPMorgan Chase helps crypto exchanges Coinbase and Gemini with deposit and withdrawal transactions Goldman Sachs has offered derivatives connected to bitcoin whilst also generating a financial loan to Coinbase secured versus bitcoin and lots of financial institutions supply wealthy buyers access to crypto financial investment money.

Lesser US lenders have ploughed additional deeply into crypto, courting digital asset shoppers these as stablecoin issuers, crypto exchanges and traders. These include things like Signature Lender, which has stated extra than a quarter of its around $120bn in dollar deposits is connected to electronic asset consumers, and Silvergate, which derived nearly all of its $29bn in deposits from digital asset consumers.

Cautious of diving in also deep, financial institutions have missed out on a lot more than 95 for every cent of the $4bn-$5bn in estimated revenues for company and institutional shoppers created in 2021 by digital property, according to a report by Morgan Stanley and Oliver Wyman.

“Banks do have to go where the prospects want them to go, so had there been shopper pressure they may possibly have engaged in more [crypto] exercise,” claimed Mitch Eitel, managing associate of the economical expert services group at Sullivan & Cromwell.

In the absence of banking companies, committed crypto creditors have stepped in for lending. These firms ordinarily tumble in two buckets: decentralised loan providers this kind of as Aave exactly where funding activity is tracked on its blockchain, and centralised loan companies these as BlockFi and Nexo.

Small immediate exposure to financial institutions would make it a lot less probable for them to act as a transmission channel for economical worry from the crypto crash as they did in 2008, according to Clifford Chance lover Jeff Berman.

“Banks never keep crypto and they’ve been quite watchful about lending from crypto. And in simple fact most of the lending versus crypto has been completed by crypto specialists. So the over-all publicity to crypto is minimal,” Berman stated.

Crypto hedge fund insiders also appear calm about the extent to which this could affect common lender key brokers and the wider monetary method.

Simply because most of the common lender key brokers that support mainstream hedge funds have yet to enter the crypto sector, crypto money are inclined to use professional digital asset brokers, although they may well nonetheless occasionally use banking institutions when they trade additional mainstream property. This is witnessed as restricting the possible for banks to run up huge losses when a fund blows up.

“I do not see this spilling more than into the traditional finance world,” claimed Edouard Hindi, main investment decision officer at electronic asset supervisor Tyr Funds. “The threat [of contagion] that exists in conventional finance doesn’t exist in crypto.”

Meanwhile, quite a few significant macro and quantitative hedge resources that have began trading crypto have performed so applying futures, for occasion on the Chicago Mercantile Trade, somewhat than the underlying cryptocurrencies by themselves.

If they have been to experience losses on this sort of positions they would “have experienced to write-up extra margin with the CME or choose cash losses with the DeFi exchanges”, explained Usman Ahmad, chief executive of Zodia Markets, a digital asset trading venue owned by Conventional Chartered.

Neither of these really should affect lender key brokers unless of course these losses signify that the fund is unable to meet up with margin phone calls at banking institutions that act as brokers for the fund’s other property, he added.

All this has led some Wall Road heavyweights to already occur to the summary that the crypto mess does not pose a systemic chance to banking companies.

“I really don’t imagine it is massive adequate to be systemic,” explained Howard Marks, co-founder and co-chair of Oaktree Cash Administration. “For anything to have systemic effect I feel it has to be section of the technique and the establishments.”

Calming statements by regulators have not generally been prescient, notably in the run-up to the 2008 subprime housing disaster when govt officials played down risks. And not anyone is reassured this time.

“I consider the systemic contagion danger from a crypto crash is real, although it is tricky to know for sure just how deeply intertwined the digital currencies are with hedge funds and other common financial firms,” reported David Coach, chief government at financial investment investigate organization New Constructs.

“As the promoting continues, we soon will uncover out just how substantially systemic hazard there is.”

By Joshua Franklin in New York, Stefania Palma in Washington, Laura Noonan in Brussels and Scott Chipolina, Laurence Fletcher, Harriet Agnew and Owen Walker in London

More Stories

Meta fined €1.2bn for unlawful data transfers

Akzo Nobel suspends 2023 outlook due to macroeconomic headwinds

Southern CEO Fanning to exit, hunt on for successor – Bloomberg News