Buy Google Stock And Short Amazon: Trading Irrational Dispersion

Dzmitry Dzemidovich

Thesis

Amazon.com, Inc. (NASDAQ:AMZN) is an amazing business, no doubt. But relative to Google/Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), the company’s stock is clearly overvalued. What’s more, Amazon’s bull case is often supported by the secular growth of the cloud business. But Google also has a cloud business. Although smaller, Google cloud business is growing faster and arguably breeds higher potential for value generation given a strong focus on PaaS (Product as a Service) versus Amazon’s (Infrastructure as a Service).

That said, I see a strong alpha-rich case for an interesting pair-trade: shorting Amazon and buying Google. Notably, as long duration assets (high P/E) stocks suffered YTD, the trade has already started working and Google has outperformed Amazon by approximately 15 percentage points (Google is down -17% versus Amazon down -32%).

Seeking Alpha

The Relative Valuation: Google Vs. Amazon

In the beginning of this article, I argued that Google is much cheaper than Amazon, on a relative basis. In this section, I will support my thesis with data. First, let us look at the most popular valuation multiple: P/E.

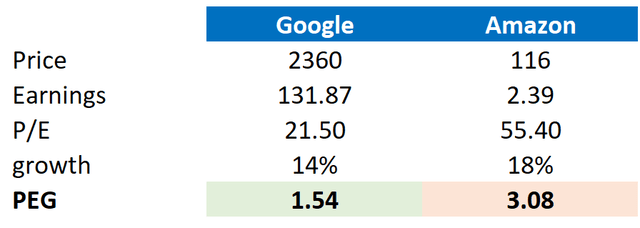

On the basis of the past 12 months, Google is trading at a P/E GAAP of x 21.6 versus x55.4 for Amazon. Notably, this is a premium of more than 100%!

Seeking Alpha

Amazon investors frequently argue that the company has such a relative high multiple because of the implied growth. I agree that the P/E is an incomplete valuation reference, because the metric doesn’t really account for a company’s expected growth. However, as compared to Google, this argument does not hold–because also Google has strong growth expectations and potential.

In order to expand the P/E metric by a company’s expected growth, I advise to use the PEG ratio. The PEG ratio is broadly considered as an informative metric to judge a stock’s relative expensiveness, taking into account both P/E and expected growth. The ratio is calculated as a P/E divided by 3-year CAGR expectation.

Most notably, if we calculate the PEG ratio for both Google and Amazon, we will again find a 100% premium for Amazon.

Analyst Consensus Estimates; Author’s Calculations

Reflecting On The Cloud Business

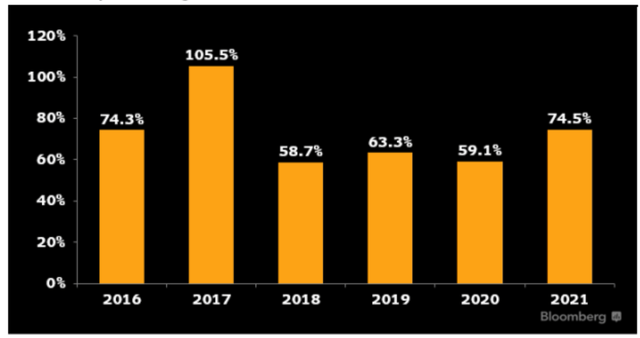

The arguments for Amazon’s relative expensiveness are often supported by the strength of AWS (Amazon Web Services, Cloud Business). According to data by Bloomberg, AWS’ 6-year cyclically adjusted contribution to Amazon’s total operating profit is approximately 70%. Or in other words: The major driver of Amazon’s business success is the cloud business.

Bloomberg Intelligence (Bloomberg Terminal)

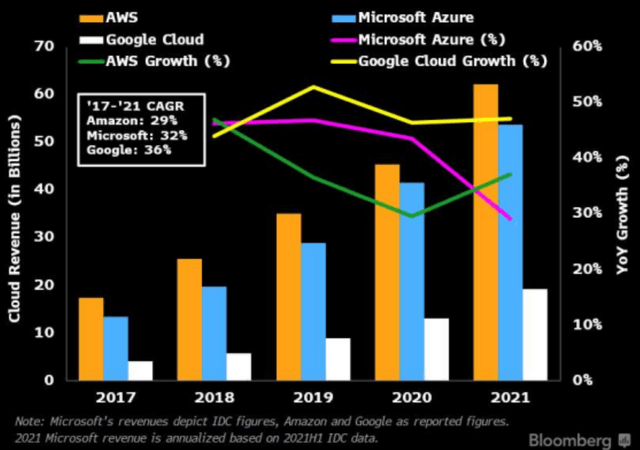

But also, Google has a cloud business, which is quickly catching up with peers. In fact, according to Bloomberg Intelligence Google’s Cloud business is growing faster than AWS. From 2017 to 2021, Google Cloud grew at a CAGR of 36% versus a CAGR of 29% for AWS. This is an outperformance of 7 percentage points. (Source: Bloomberg Intelligence, July 2022).

Data: IDC; Source Bloomberg Terminal

True, Google’s Cloud exposure is considerably smaller than Amazon’s. However, Google’s cloud service portfolio should be more profitable. As of December 2021, Amazon’s cloud service portfolio is approximately 80% IaaS, with a gross margin around 40% – 50%. Google, however, given the company’s strength in AI and data analytics is mostly focused on PaaS, with a gross margin between 60% – 70%. (Source: Bloomberg Intelligence, July 2022).

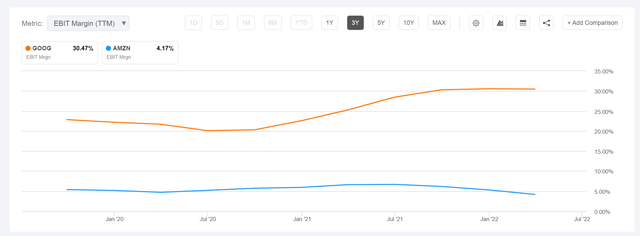

In general, Google’s operating profit margin is much more attractive than Amazon’s. With 4.2% EBIT margin, Amazon is barely profitable. Google, however, with 30% EBIT margin, is more than twice as profitable as the typical technology company. The argument that Amazon is expensing 11.9% of revenues in R&D does not hold, because Google is expensing even more: 12.2%.

Seeking Alpha

Why Shorting Amazon Is Necessary

Both Amazon and Google are amazing companies with multi-year growth potential. If Google is relatively cheaper than Amazon, why not simply buy Google? Why do I also advocate shorting Amazon?

The argument is simple: I believe the general stock market is going lower–or at least it is an elevated possibility. Investors should consider the current volatile market environment, led by inflation fears, interest rate risks and discussions about a potential recession.

While I am happy to buy Google’s idiosyncratic risk profile, I am less happy to assume a systematic risk coming from a general market-sell off, which would likely also depreciate Google’s market capitalization. In case of a recession, however, I believe Amazon’s commerce business is at least equally exposed to an economy slowdown as Google’s high ROI advertising business. What’s more, in case of an EPS-independent multiple compression for FAAMG companies, I argue Amazon’s x55 P/E has a lot more downside than Google’s x21 P/E.

Finally, I argue that a short position in the Amazon versus a long position in Google will provide investors some structural alpha, independent of the above-mentioned concerns, as a residual valuation framework anchored on EPS consensus estimates indicate downside for Amazon, and upside for Google.

Relative Price Targets

Now, let us try to find a reasonable target price for both Amazon and Google shares. Personally, I am a big believer in valuing a company based on a residual earnings framework (1), anchored on analyst consensus for the next 2-3 years (2) and with reasonable/conservative cost of capital and TV growth assumptions (3). Furthermore, to aid comparison, if two companies are valued such in this pair-trade idea, I also advocate anchoring on the same assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of July 01, 2022.

- For the terminal growth rate, I anchor on expected nominal GDP growth and adjust for elevated/depressed growth expectations.

- I do not model any share-buybacks.

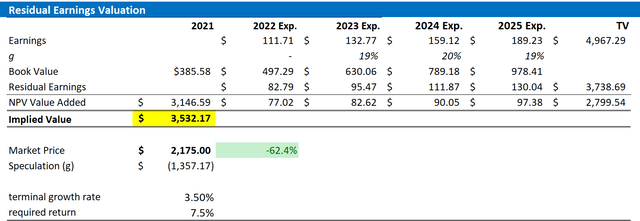

Google Valuation

Based on the above assumptions, my valuation estimates a fair share price of $3532.17/share, implying more than 60% upside for the stock.

Analyst Consensus EPS; Author’s Calculation

Amazon Valuation

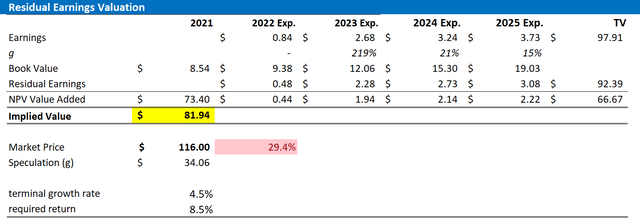

My base-case target price for AMZN is $81.94/share, implying that Amazon stock could have approximately 30% downside.

Analyst Consensus EPS; Author’s Calculation

Risks To My Thesis

First, investors should monitor competitive forces in the cloud industry. I highlighted Google’s operating margins potential for the cloud could be significantly higher than margins for AWS. However, more data is needed to confirm the margin discrepancy. Moreover, in terms of revenue and market share, AWS is significantly larger than Google. Although the trend looks favorably for Google, there is no guarantee that Google will ever catch up.

Second, arguably most of Google’s and Amazon’s current share price volatility – especially to the downside – is driven by investor sentiment towards stocks. Thus, significant volatility could impact the companies’ relative valuation, even though their respective business outlook remains unchanged.

Third, both Amazon’s and Google’s size and scale are too difficult to ignore for antitrust officials. While both companies are significantly exposed to regulatory risk, a scenario where Google get hit, but Amazon doesn’t is not unthinkable (but also vice versa). For interested readers, there was an amazing article written by a Seeking Alpha analyst: Google Stock: This Regulatory Pressure Is A Disaster (GOOG). I highly advise reading the article.

Conclusion And Trade Recommendation

I believe Google is deeply undervalued as compared to Amazon. Judged by the relative PEG ratio, Amazon trades at a 100% premium. This is not justified, in my opinion, since both Amazon and Google are equally exposed to secular growth drivers–although slightly differently. Moreover, based on a residual earnings valuation anchored on analyst consensus EPS estimates, I calculate more than 60% upside for Google, but approximately 30% downside for Amazon. Given my analysis, I advise to initiate a dollar-for-dollar pair trade: go long Google and short Amazon.